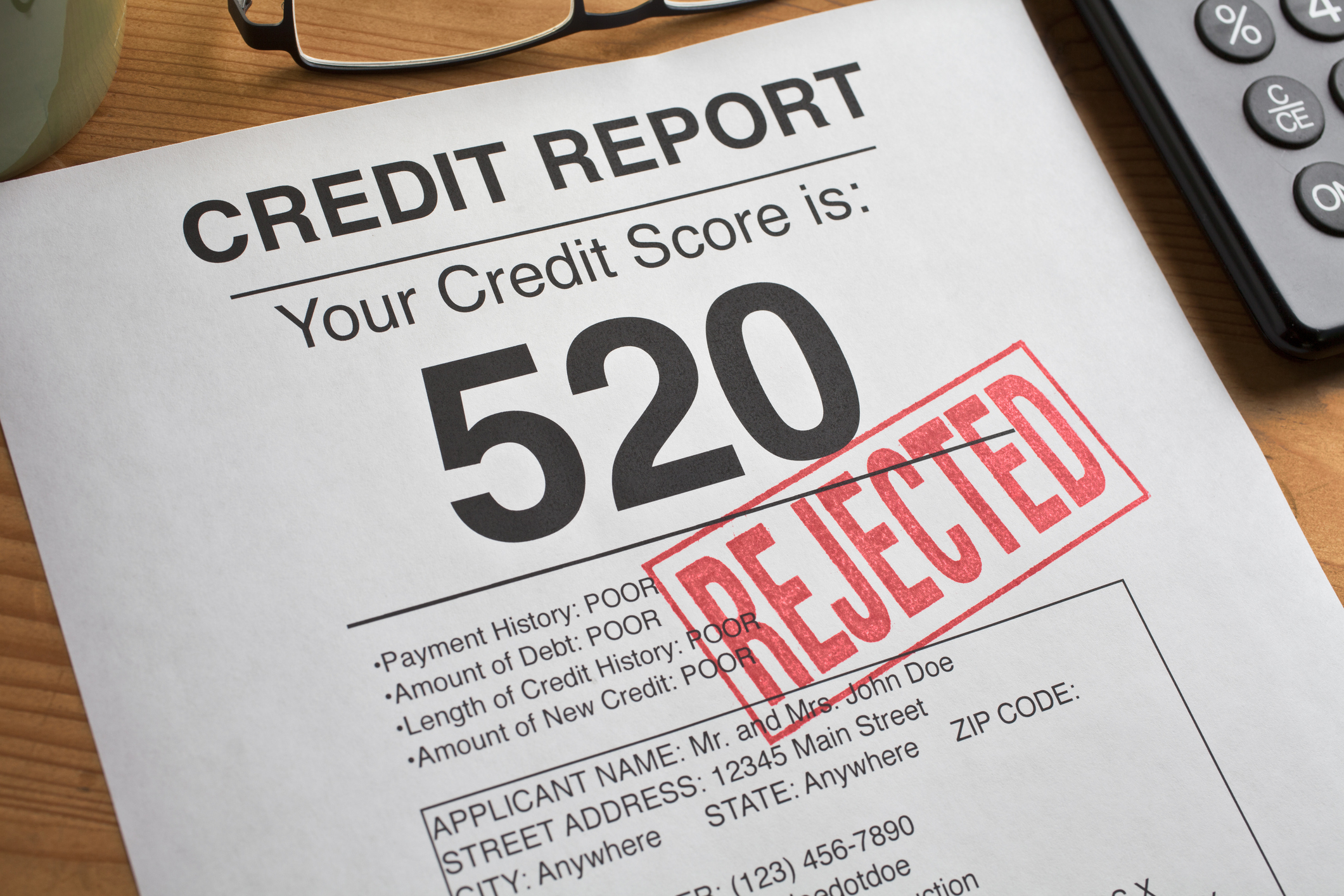

If you’re looking for financing, your credit score will affect several factors including the amount you can borrow and the interest rate you will pay. That credit score will give you access to financing for a house, a car, college tuition, store credit and more. A higher score will put you in a lower risk category of borrowers. A lower score will lead to higher interest rates and fees. So it’s important to understand what goes into a credit score.

The credit scoring model calculates credit balance against your high credit limit. This is calculated in percentages. It’s important to keep your balances as low as possible. If you have a card with a $5,000 get credit limit, keeping your balance below $500 puts you in the 10% range of available credit. There are thresholds in debt ratio that will make your credit score jump higher. These thresholds are 70%, 50%, 30% and 10%. If you can’t pay off your credit cards all the way, pay them down BELOW the next possible threshold. Calculate your credit limits in this way.

High tech way; as mentioned in #1, there are many apps that can help you track you spending and budget. By following a budget, you can see where your money goes, and plan for bigger expenses (new furniture, vacations, etc) without charging up your plastic.

The point is to get some helpful information on your credit report. If you want to rebuild your credit after bankruptcy, getting a Max credit score card even secured, is not so you can go crazy shopping. (Don’t forget why you’re here) Use your new card easy and pay it off in full on or even before the due date. If you can’t make that happen in any given month don’t use it.

Remove cosigners from your accounts. Adding a cosigner is a good way to get credit, especially when you are first starting to repair your credit score – and they offer another chance to bolster your score when you remove them. Once your credit gets to a point where you can qualify without cosigners, call your financial institution and remove them from your existing accounts.

Anyone can get a copy of their credit reports because of those two acts. They’ll charge you a $35 fee to get them, but we need to see your reports in order to fix the problems. Once we have a copy of your credit reports we’ll go through the negative items (i.e. late payments, outdated or inaccurate information, judgments, collections…the usual) and work to get as many of them legally removed as possible. All the things that lenders, credit card companies, auto dealers, and so on look at when they decide whether to give you that car, credit card, interest rate, or home loan you want.

With good credit, it is easier for one to apply for credit or a loan and to have lower interest rates. It is easier to get a job, a home and a car. You can also have the chance to apply for loans that do not require too much documentation of your income and assets. Therefore, it is truly advantageous to get credit repair help and have a good credit rating. Not everyone has a good credit record. However, repairing bad credit is actually far more necessary than you thought. Here’s why you need credit repair help and how to get it.